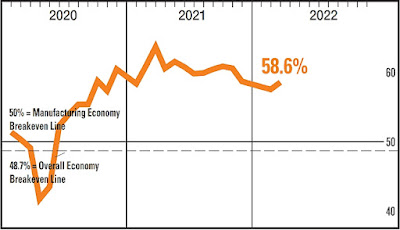

ISM Manufacturing Index for February 2022

Earlier today, the Institute for Supply Management® (ISM®) released their Manufacturing Purchasing Manager's Index (PMI®) for February 2022:

=========

Predicted: 58.0%

=========

Previous month (revised): 57.6%

=========

Every month, the ISM surveys purchasing and supply executives at hundreds of companies across the country who are involved in manufacturing in some form. The resulting index is watched closely by academics, economists and investors because manufacturing accounts for about 12% of U.S. Gross Domestic Product (GDP).

The PMI is a reliable barometer of U.S. manufacturing: A PMI above 50% implies that U.S. manufacturing expanded during the month specified, while a reading below 50% implies that the made-in-the-USA sector contracted.

=========

=========

Predicted: 58.0%

- Actual: 58.6% (+1.0 point month-on-month change)

=========

Previous month (revised): 57.6%

=========

Every month, the ISM surveys purchasing and supply executives at hundreds of companies across the country who are involved in manufacturing in some form. The resulting index is watched closely by academics, economists and investors because manufacturing accounts for about 12% of U.S. Gross Domestic Product (GDP).

The PMI is a reliable barometer of U.S. manufacturing: A PMI above 50% implies that U.S. manufacturing expanded during the month specified, while a reading below 50% implies that the made-in-the-USA sector contracted.

=========

From Today's Report:

"...Economic activity in the manufacturing sector grew in February, with the overall economy achieving a 21st consecutive month of growth, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®..."

=========

The Following Is A Sampling Of Quotes

From A Diverse Pool Of U.S. Manufacturers:

From A Diverse Pool Of U.S. Manufacturers:

- "...'Electronic supply chain is still a mess.'

[Computer + Electronic Products]

- 'Strong sales growth as retail continues to return.'

[Chemical Products]

- 'Demand for transportation equipment remains strong. Supply of transportation services continues to be a major issue for the supply chain.'

[Transportation Equipment]

- 'Strong demand has continued beyond our traditional seasonality curves. Coupled with the continuing difficulties in procurement of ocean freight, operational planning and managing costs are our biggest challenges.'

[Food, Beverage + Tobacco Products]

- 'We have seen year-over-year revenue growth of about 10 percent due to markets coming back. However, in the automotive area, the microchip shortage is causing slowness in growth.'

[Machinery]

- 'Demand for steel products has increased to historic levels, driven by the automotive and energy industries.'

[Fabricated Metal Products]

- 'We are expecting a year of strong demand, higher prices and continued supply chain challenges.'

[Textile Mills]

- 'Demand continues to be strong, increasing our backlog. Production has been more consistent due to availability of parts, but we are not able to increase builds to cut into the backlog.'

[Electrical Equipment, Appliances + Components]

- 'Business conditions are good, demand remains strong, and we continue to be challenged to keep up with demand.'

[Miscellaneous Manufacturing]

- 'Business is still strong. Facing logistics and raw material supply chain issues with some products.'

[Plastics + Rubber Products]..."

=========

CHART: ISM Manufacturing Index

February 2022 Update

February 2022 Update

Labels: Chip_Shortage, Computer_Chips, Coronavirus, COVID-19, COVID19, hard_data, inflation, ism, manufacturing, Pandemic, pmi, purchasing_managers_index, Supply_Chain

|

--> www.FedPrimeRate.com Privacy Policy <--

CLICK HERE to JUMP to the TOP of THIS PAGE > SITEMAP < |

0 Comments:

Post a Comment

<< Home