Employment Cost Index for Q1, 2023

Employment Cost Index (ECI) for the first quarter of 2023 was released by The Labor Department's Bureau of Labor Statistics this morning:

Predicted: +1.1%

Actual: +1.2%

The yellow-highlighter figure represents the seasonally adjusted, quarter-to-quarter change for the ECI, which is the Labor Department's broadest measure of employee-compensation costs, and includes wages, salaries and benefits.

==================

==================

==================

From the Labor Department website:

==================

==================

Predicted: +1.1%

Actual: +1.2%

- Reading from previous quarter: +1.1%

- Change from 12 months previous (Y/Y): +4.8%

The yellow-highlighter figure represents the seasonally adjusted, quarter-to-quarter change for the ECI, which is the Labor Department's broadest measure of employee-compensation costs, and includes wages, salaries and benefits.

==================

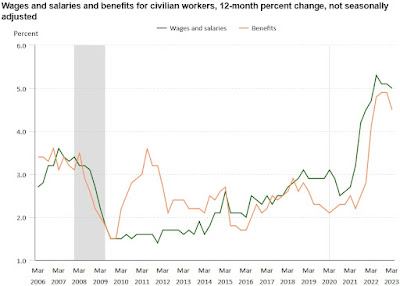

- Wages and Salaries: +1.2%

- Change from 12 months previous (Y/Y): +5.0%

==================

- Benefits: +1.2%

- Change from 12 months previous (Y/Y): +4.5%

==================

From the Labor Department website:

"...The Employment Cost Index (ECI) measures the change in the cost of labor, free from the influence of employment shifts among occupations and industries..."

==================

CHART: Wages and Salaries and Benefits

for Civilian Workers

12 Month Percent Change

Not Seasonally Adjusted

First Quarter, 2023 UPDATE

for Civilian Workers

12 Month Percent Change

Not Seasonally Adjusted

First Quarter, 2023 UPDATE

==================

Labels: benefits, Coronavirus, COVID-19, COVID19, employment, Employment_Cost_Index, hard_data, inflation, jobs, labor, labor_cost, wages

|

--> www.FedPrimeRate.com Privacy Policy <--

CLICK HERE to JUMP to the TOP of THIS PAGE > SITEMAP < |

0 Comments:

Post a Comment

<< Home