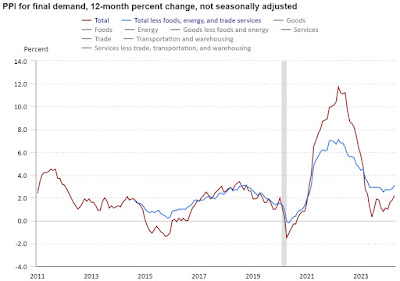

Producer Price Index - Final Demand (PPI-FD) for April 2024

Previous Month (unrevised): +0.2%

- > Actual: +0.5%

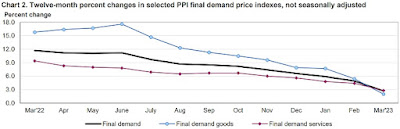

Change from 12 months previous: +2.2% (prior = +2.1%)

=============

Below is the PPI-FD when food, energy and trade services are removed:

Previous Month (unrevised): +0.2%

- > Actual: +0.4%

=============

The above, yellow-highlighted percentages represent the month-to-month change in prices received by domestic producers of goods and services, for goods, services and construction in the United States, for final demand.

Final Demand = personal consumption (consumers), exports, government purchases and capital investment.

The PPI-FD is released by the Labor Department's Bureau of Labor Statistics.

The "predicted" figure is what economists were expecting, while the "actual" is the true or real figure.

==============

Labels: Coronavirus, COVID-19, COVID19, hard_data, inflation, ppi, ppi-fd, producer_price_index, wholesale, wholesale_prices

|

--> www.FedPrimeRate.com Privacy Policy <--

CLICK HERE to JUMP to the TOP of THIS PAGE > SITEMAP < |