Consumer Sentiment: Final Results for May 2022

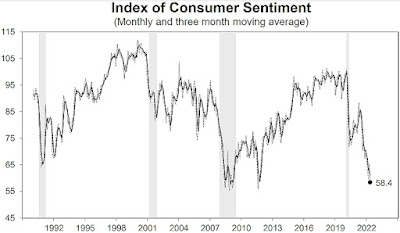

The University of Michigan's Index of Consumer Sentiment (ICS) - Final Results for May 2022 was released today:

Predicted: 59.0

=========

=========

From today's report:

Predicted: 59.0

- Actual: 58.4

- Change from Previous Month: -10.43% (-6.8 points)

- Change from 12 Months Previous: -29.55% (-24.5 points)

=========

- Final ICS Reading for April 2022: 65.2

- Final ICS Reading for May 2021: 82.9

=========

From today's report:

"...The final May reading confirmed the early month decline in consumer sentiment, which fell 10.4% below April and reverted to virtually the same level of sentiment seen in March. This recent drop was largely driven by continued negative views on current buying conditions for houses and durables, as well as consumers’ future outlook for the economy, primarily due to concerns over inflation. At the same time, consumers expressed less pessimism over future prospects for their personal finances than over future business conditions.

Less than one quarter of consumers expected to be worse off financially a year from now.

Looking into the long term, a majority of consumers expected their financial situation to improve over the next five years; this share is essentially unchanged during 2022. A stable outlook for personal finances may currently support consumer spending. Still, persistently negative views of the economy may come to dominate personal factors in influencing consumer behavior in the future..."

=========

=========

The ICS uses a 1966 baseline, i.e. for 1966, the ICS = 100. So any number that is below the 1966 baseline of 100 means that the folks who were polled recently aren't as optimistic about the U.S. economy as those polled back in 1966.

The ICS is similar to the Consumer Confidence Index in that they both measure consumer attitudes and offer valuable insight into consumer spending.

=========

The "predicted" figure is what economists were expecting, while the "actual" is the true or real figure.

=========

The ICS is derived from the following five survey questions:

- "We are interested in how people are getting along financially these

days. Would you say that you (and your family living there) are

better off or worse off financially than you were a year ago?"

- "Now looking ahead, do you think that a year from now you (and your

family living there) will be better off financially, or worse off, or

just about the same as now?"

- "Now turning to business conditions in the country as a whole, do

you think that during the next twelve months we'll have good times

financially, or bad times, or what?"

- "Looking ahead, which would you say is more likely: that in the

country as a whole we'll have continuous good times during the next five

years or so, or that we will have periods of widespread unemployment or depression, or what?"

- "About the big things people buy for their homes, such as furniture,

a refrigerator, stove, television, and things like that. Generally

speaking, do you think now is a good or bad time for people to buy major

household items?"

- Click here for more on how the ICS is calculated.

=========

The ICS uses a 1966 baseline, i.e. for 1966, the ICS = 100. So any number that is below the 1966 baseline of 100 means that the folks who were polled recently aren't as optimistic about the U.S. economy as those polled back in 1966.

The ICS is similar to the Consumer Confidence Index in that they both measure consumer attitudes and offer valuable insight into consumer spending.

=========

The "predicted" figure is what economists were expecting, while the "actual" is the true or real figure.

=========

=========

Labels: consumer_sentiment, consumers, Coronavirus, COVID-19, COVID19, Pandemic, soft_data

|

--> www.FedPrimeRate.com Privacy Policy <--

CLICK HERE to JUMP to the TOP of THIS PAGE > SITEMAP < |

0 Comments:

Post a Comment

<< Home