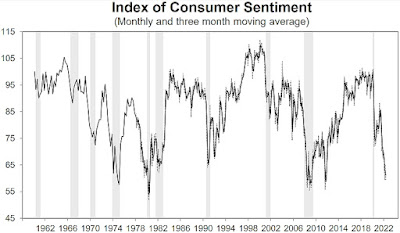

Consumer Sentiment: Preliminary Results for May 2022

The University of Michigan's Index of Consumer Sentiment (ICS) - Preliminary Results for May 2022 was released today:

Predicted: 61.0

=========

=========

From today's report:

Predicted: 61.0

- Actual: 59.1

- Change from Previous Month: -9.36% (-6.1 points)

- Change from 12 Months Previous: -28.71% (-23.8 points)

=========

- Final ICS Reading for April 2022: 65.2

- Final ICS Reading for May 2021: 82.9

=========

From today's report:

"...Consumer sentiment declined by 9.4% from April, reversing gains realized that month. These declines were broad based -- for current economic conditions as well as consumer expectations, and visible across income, age, education, geography, and political affiliation -- continuing the general downward trend in sentiment over the past year. Consumers' assessment of their current financial situation relative to a year ago is at its lowest reading since 2013, with 36% of consumers attributing their negative assessment to inflation. Buying conditions for durables reached its lowest reading since the question began appearing on the monthly surveys in 1978, again primarily due to high prices.

The median expected year-ahead inflation rate was 5.4%, little changed over the last three months, and up from 4.6% in May 2021. The mean was considerably higher at 7.4%, reflecting substantial variation in price changes across types of goods and services, and in household spending patterns. At the same time, long term inflation expectations remain well-anchored with a median of 3.0%, settling within the 2.9 to 3.1% range seen over the last 10 months..."

=========

=========

The ICS uses a 1966 baseline, i.e. for 1966, the ICS = 100. So any number that is below the 1966 baseline of 100 means that the folks who were polled recently aren't as optimistic about the U.S. economy as those polled back in 1966.

The ICS is similar to the Consumer Confidence Index in that they both measure consumer attitudes and offer valuable insight into consumer spending.

=========

The "predicted" figure is what economists were expecting, while the "actual" is the true or real figure.

=========

The ICS is derived from the following five survey questions:

- "We are interested in how people are getting along financially these

days. Would you say that you (and your family living there) are

better off or worse off financially than you were a year ago?"

- "Now looking ahead, do you think that a year from now you (and your

family living there) will be better off financially, or worse off, or

just about the same as now?"

- "Now turning to business conditions in the country as a whole, do

you think that during the next twelve months we'll have good times

financially, or bad times, or what?"

- "Looking ahead, which would you say is more likely: that in the

country as a whole we'll have continuous good times during the next five

years or so, or that we will have periods of widespread unemployment or depression, or what?"

- "About the big things people buy for their homes, such as furniture,

a refrigerator, stove, television, and things like that. Generally

speaking, do you think now is a good or bad time for people to buy major

household items?"

- Click here for more on how the ICS is calculated.

=========

The ICS uses a 1966 baseline, i.e. for 1966, the ICS = 100. So any number that is below the 1966 baseline of 100 means that the folks who were polled recently aren't as optimistic about the U.S. economy as those polled back in 1966.

The ICS is similar to the Consumer Confidence Index in that they both measure consumer attitudes and offer valuable insight into consumer spending.

=========

The "predicted" figure is what economists were expecting, while the "actual" is the true or real figure.

=========

=========

Labels: consumer_sentiment, consumers, Coronavirus, COVID-19, COVID19, Pandemic, soft_data

|

--> www.FedPrimeRate.com Privacy Policy <--

CLICK HERE to JUMP to the TOP of THIS PAGE > SITEMAP < |

0 Comments:

Post a Comment

<< Home