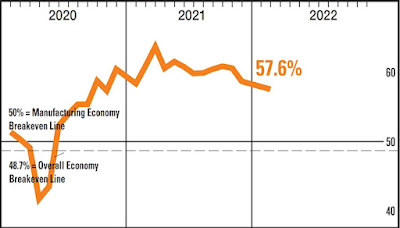

ISM Manufacturing Index for January 2022

Earlier today, the Institute for Supply Management® (ISM®) released their Manufacturing Purchasing Manager's Index (PMI®) for January 2022:

=========

Predicted: 58.0%

=========

Previous month (revised): 58.8%

=========

Every month, the ISM surveys purchasing and supply executives at hundreds of companies across the country who are involved in manufacturing in some form. The resulting index is watched closely by academics, economists and investors because manufacturing accounts for about 12% of U.S. Gross Domestic Product (GDP).

The PMI is a reliable barometer of U.S. manufacturing: A PMI above 50% implies that U.S. manufacturing expanded during the month specified, while a reading below 50% implies that the made-in-the-USA sector contracted.

=========

From Today's Report:

The following is a sampling of quotes from a diverse pool of U.S. manufacturers:

=========

Predicted: 58.0%

- Actual: 57.6% (-1.2 points month-on-month change)

=========

Previous month (revised): 58.8%

=========

Every month, the ISM surveys purchasing and supply executives at hundreds of companies across the country who are involved in manufacturing in some form. The resulting index is watched closely by academics, economists and investors because manufacturing accounts for about 12% of U.S. Gross Domestic Product (GDP).

The PMI is a reliable barometer of U.S. manufacturing: A PMI above 50% implies that U.S. manufacturing expanded during the month specified, while a reading below 50% implies that the made-in-the-USA sector contracted.

=========

From Today's Report:

"...Economic activity in the manufacturing sector grew in January, with the overall economy achieving a 20th consecutive month of growth, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®..."

=========

The following is a sampling of quotes from a diverse pool of U.S. manufacturers:

- "...'We are experiencing massive interruptions to our production due to supplier COVID-19 problems limiting their manufacturing of key raw (materials) like steel cans and chemicals.'

[Chemical Products]

- 'While there has been some improvement in materials making it to our factories and logistics centers, we are still constrained by (a lack of) qualified labor. Orders so far are not being cancelled, but we are concerned that customers may be losing patience.'

[Computer + Electronic Products]

- 'Transportation, labor and inflation issues continue to hamper our supply chain and ability to service our customers. Fortunately, it’s also hampering our competition as well. Ultimately, the biggest impact is at the consumer level, as (price increases) continue to get passed through.'

[Transportation Equipment]

- 'Our suppliers are having difficulty meeting scheduled releases as their suppliers experience delays and shortages, so lead times and inventories are struggling, resulting in lost production.'

[Food, Beverage + Tobacco Products]

- 'Lack of skilled production personnel, either from missing work due to (COVID-19) variants or leaving for better opportunities, making it more difficult to complete work. Working off a backlog.'

[Fabricated Metal Products]

- 'Strong backlog of orders coming into the new year. Potential to beat target revenue, depending on availability of purchased product.'

[Electrical Equipment, Appliances + Components]

- 'Bookings continue to increase as we are still dealing with a shortage of labor and supply chain issues.'

[Furniture + Related Products]

- 'Transportation restrictions and a lack of supplier manpower continue to create significant shortages that limit our production. This, in turn, limits what we can supply to customers, as well as on-time delivery.'

[Machinery]

- 'Integrated circuit availability is really causing issues. Shortages of raw materials and other electronic materials continue to hamper deliveries to our customers.'

[Miscellaneous Manufacturing]

- 'The supply chain crunch may be loosening a bit; however, specific original equipment manufacturer (OEM) parts and equipment now have lead times that we have not experienced before.'

[Nonmetallic Mineral Products]..."

=========

CHART: ISM Manufacturing Index

January 2022 Update

Labels: Coronavirus, COVID-19, COVID19, hard_data, ism, manufacturing, Pandemic, pmi, purchasing_managers_index

|

--> www.FedPrimeRate.com Privacy Policy <--

CLICK HERE to JUMP to the TOP of THIS PAGE > SITEMAP < |

0 Comments:

Post a Comment

<< Home