Consumer Sentiment: Final Results for February 2022

The University of Michigan's Index of Consumer Sentiment (ICS) - Final Results for February 2022 was released today:

Predicted: 70.0

=========

=========

From today's report:

Predicted: 70.0

- Actual: 62.8

- Change from Previous Month: -6.55% (-4.4 points)

- Change from 12 Months Previous: -18.23% (-14.0 points)

=========

- Final ICS Reading for January 2022: 67.2

- Final ICS Reading for February 2021: 76.8

=========

From today's report:

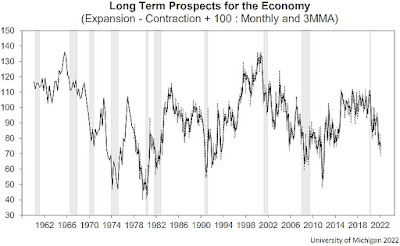

"...Although Consumer Sentiment posted a slight increase in the last half of February, it still remained at its lowest level in the past decade, and the loss was still entirely due to a 12.9% decline among households with incomes of $100,000 or more. The February descent resulted from inflationary declines in personal finances, a near universal awareness of rising interest rates, falling confidence in the government's economic policies, and the most negative long term prospects for the economy in the past decade (see the chart).

Virtually all interviews were conducted prior to the Russian invasion so its impact is yet to be felt by consumers. The most likely linkage to the domestic economy is through rising energy prices, with the size and length of the potential increases subject to substantial uncertainty. This will complicate the Fed's policy actions, tilting their objectives to focus more on inflation at the cost of slower growth and higher unemployment. The financial harm and growing angst among consumers about rising inflation have pushed nearly nine-in-ten consumers to anticipate interest rate hikes. The Fed's clinging to the transient hypothesis meant missed opportunities to nip inflation at its earliest stages; aggressive actions are now needed to avoid the potential establishment of an inflationary psychology that acts to form a self-fulfilling prophecy.

The imposition of sanctions against Russia is likely to generate counter measures that could harm the domestic economy, requiring the Fed to give special consideration to any associated economic slowdown and rising unemployment. Presumably, economic sanctions would be lifted only if Ukraine's sovereignty is maintained, but not if Russia prevails. Consumers may double-down on precautionary behaviors if the greater cyber risks associated with the conflict are now borne by domestic households..."

=========

=========

The ICS uses a 1966 baseline, i.e. for 1966, the ICS = 100. So any number that is below the 1966 baseline of 100 means that the folks who were polled recently aren't as optimistic about the U.S. economy as those polled back in 1966.

The ICS is similar to the Consumer Confidence Index in that they both measure consumer attitudes and offer valuable insight into consumer spending.

=========

The "predicted" figure is what economists were expecting, while the "actual" is the true or real figure.

=========

The ICS is derived from the following five survey questions:

- "We are interested in how people are getting along financially these

days. Would you say that you (and your family living there) are

better off or worse off financially than you were a year ago?"

- "Now looking ahead, do you think that a year from now you (and your

family living there) will be better off financially, or worse off, or

just about the same as now?"

- "Now turning to business conditions in the country as a whole, do

you think that during the next twelve months we'll have good times

financially, or bad times, or what?"

- "Looking ahead, which would you say is more likely: that in the

country as a whole we'll have continuous good times during the next five

years or so, or that we will have periods of widespread unemployment or depression, or what?"

- "About the big things people buy for their homes, such as furniture,

a refrigerator, stove, television, and things like that. Generally

speaking, do you think now is a good or bad time for people to buy major

household items?"

- Click here for more on how the ICS is calculated.

=========

The ICS uses a 1966 baseline, i.e. for 1966, the ICS = 100. So any number that is below the 1966 baseline of 100 means that the folks who were polled recently aren't as optimistic about the U.S. economy as those polled back in 1966.

The ICS is similar to the Consumer Confidence Index in that they both measure consumer attitudes and offer valuable insight into consumer spending.

=========

The "predicted" figure is what economists were expecting, while the "actual" is the true or real figure.

=========

=========

Labels: consumer_sentiment, consumers, Coronavirus, COVID-19, COVID19, Pandemic, soft_data

|

--> www.FedPrimeRate.com Privacy Policy <--

CLICK HERE to JUMP to the TOP of THIS PAGE > SITEMAP < |

0 Comments:

Post a Comment

<< Home