Leading Economic Index for January 2022

The Conference Board® released its Leading Economic Index® (LEI) for January 2022 this morning:

==============

Index for January 2022: 119.6 (The baseline 100 score is associated with 2016 data.)

==============

Predicted: FLAT

==============

==============

The yellow-highlighted percentage is the month-to-month change for the index. The "predicted" figure is what economists were expecting, while the "actual" is the true or real figure.

The LEI is a composite of 10 of the nation's economic data releases that's put together by The Conference Board. Statistically, the components listed below have shown a significant increase or decrease before national economic upturns or downturns:

==============

==============

==============

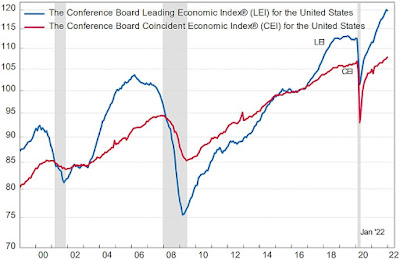

Index for January 2022: 119.6 (The baseline 100 score is associated with 2016 data.)

==============

Predicted: FLAT

- Actual: -0.333% (-0.4 point)

==============

- LEI for December 2021: 120.0

- LEI for November 2021: 119.2

==============

The yellow-highlighted percentage is the month-to-month change for the index. The "predicted" figure is what economists were expecting, while the "actual" is the true or real figure.

The LEI is a composite of 10 of the nation's economic data releases that's put together by The Conference Board. Statistically, the components listed below have shown a significant increase or decrease before national economic upturns or downturns:

- The Standard + Poor's 500 Index

- Average weekly claims for unemployment insurance

- Building permits for new private housing

- The interest rate spread between the yield on the benchmark 10-Year Treasury Note and Federal Funds

- ISM® Index of New Orders

- Manufacturer's new orders for consumer goods or materials

- Manufacturers' new orders, nondefense capital goods excluding aircraft orders

- Average weekly manufacturing hours

- Average consumer expectations for business conditions

- Leading Credit Index™

==============

==============

==============

From Today's Report:

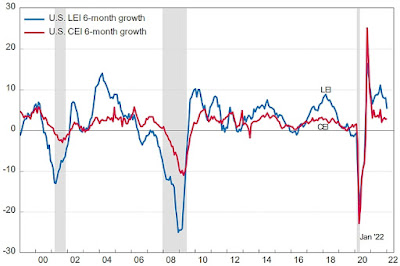

"...'The U.S. LEI posted a small decline in January, as the Omicron wave, rising prices, and supply chain disruptions took their toll,' said Ataman Ozyildirim, Senior Director of Economic Research at The Conference Board. 'Initial claims for unemployment insurance, consumers’ outlook and declines in stock prices, and the average work week in manufacturing all contributed to the decline -- the first since February 2021.

'Despite this month’s decline and a deceleration in the LEI’s six-month growth rate, widespread strengths among the leading indicators still point to continued, albeit slower, economic growth into the spring. However, labor shortages, inflation, and the potential of new COVID-19 variants pose risks to growth in the near term. The Conference Board forecasts GDP growth for Q1 to slow somewhat from the very rapid pace of Q4 2021. Still, the US economy is projected to expand by a robust 3.5 percent year-over-year in 2022—well above the pre-pandemic growth rate, which averaged around 2 percent.'..."

==============

Labels: Coronavirus, COVID-19, COVID19, hard_data, Leading_Economic_Index, leading_economic_indicators, Pandemic, The_Conference_Board

|

--> www.FedPrimeRate.com Privacy Policy <--

CLICK HERE to JUMP to the TOP of THIS PAGE > SITEMAP < |

0 Comments:

Post a Comment

<< Home