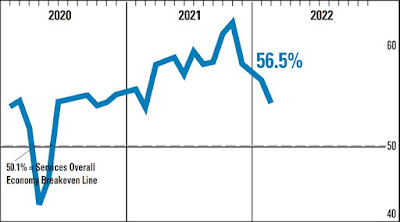

ISM Non-Manufacturing Index (NMI®) for February 2022

Earlier today, the Institute for Supply Management (ISM®) released their Non-Manufacturing Index (NMI®) for February 2022:

==========

Predicted: 60.0%

==========

Previous month (revised): 59.9%

==========

The NMI is a reliable barometer of the U.S. services sector; above 50% implies expansion, while a reading below 50% implies that the services sector contracted.

Service Categories Include: Agriculture, Forestry, Fishing + Hunting; Mining; Utilities; Construction; Wholesale Trade; Retail Trade; Transportation + Warehousing; Information; Finance + Insurance; Real Estate, Rental + Leasing; Professional, Scientific + Technical Services; Management of Companies + Support Services; Educational Services; Health Care + Social Assistance; Arts, Entertainment + Recreation; Accommodation + Food Services; Public Administration; and Other Services (services such as Equipment + Machinery Repairing; Promoting or Administering Religious Activities; Grantmaking; Advocacy; and Providing Dry-Cleaning + Laundry Services, Personal Care Services, Death Care Services, Pet Care Services, Photofinishing Services, Temporary Parking Services, and Dating Services).

==========

From today' report:

===========

Here's a sampling of comments made by survey participants:

==========

==========

Predicted: 60.0%

- Actual: 56.5% (-3.4 points month-on-month change)

==========

Previous month (revised): 59.9%

==========

The NMI is a reliable barometer of the U.S. services sector; above 50% implies expansion, while a reading below 50% implies that the services sector contracted.

Service Categories Include: Agriculture, Forestry, Fishing + Hunting; Mining; Utilities; Construction; Wholesale Trade; Retail Trade; Transportation + Warehousing; Information; Finance + Insurance; Real Estate, Rental + Leasing; Professional, Scientific + Technical Services; Management of Companies + Support Services; Educational Services; Health Care + Social Assistance; Arts, Entertainment + Recreation; Accommodation + Food Services; Public Administration; and Other Services (services such as Equipment + Machinery Repairing; Promoting or Administering Religious Activities; Grantmaking; Advocacy; and Providing Dry-Cleaning + Laundry Services, Personal Care Services, Death Care Services, Pet Care Services, Photofinishing Services, Temporary Parking Services, and Dating Services).

==========

From today' report:

"...Economic activity in the services sector grew in February for the 21st month in a row -- with the Services PMI® registering 56.5 percent -- say the nation’s purchasing and supply executives in the latest Services ISM® Report On Business®..."

===========

- "...'Raw material increases, labor shortages, wage increases and transportation issues are still the primary issues affecting our operations and pricing.'

[Accommodation + Food Services]

- 'Supply chain challenges continue to result in lower inventories of products and higher costs. The challenges are at the highest point since COVID-19 began.'

[Agriculture, Forestry, Fishing + Hunting]

- 'We are projecting 2022 to be busier than 2021. Our business volume should begin to increase significantly in March.'

[Arts, Entertainment + Recreation]

- 'We are getting price increases with no notice. For example, our engineered wood products supplier gave us a 10 percent to 20 percent (based on SKU) increase, effective immediately. We are also struggling to get materials. Suppliers cite poor employee attendance, elevated employee turnover and positions open longer than normal as they struggle to fill them.'

[Construction]

- 'Inflation is contributing to budget constraints, supply chain restraints and labor shortages.'

[Educational Services]

- 'Employee turnover within our company and with our suppliers is causing delays in decisions and orders.'

[Finance + Insurance]

- 'As the COVID-19 surge starts to loosen its grip, we are planning to resume elective surgeries soon. Demand is still high, as these procedures were delayed while the surge was occurring.'

[Health Care + Social Assistance]

- 'Business has flattened but holding steady.'

[Information]

- 'Staffing shortages, supply chain disruptions and rising inflation continue to impact the world economy. Companies are struggling to hire direct employees and non-employee labor because wages continue to increase for both. The Great Resignation is real: Employees, contractors and consultants continue to quit their jobs and engagements for opportunities that pay more and have more flexible work options. Millions of light industrial jobs remain open in the U.S., with limited interest from job seekers. Severe labor shortages are expected well into 2022. Corporations need to increase wages and salaries to attract talent and get work done. Faster wage growth is expected to lead to increased inflation.'

[Professional, Scientific + Technical Services]

===========

- 'Appear to be on the upswing from COVID-19 from an absenteeism standpoint. Still dealing with long lead times for wire, polyvinyl chloride (PVC), steel, transformers and meters. Winter weather has not had an impact on productivity levels.'

[Utilities]

==========

Labels: Coronavirus, COVID-19, COVID19, hard_data, Institute_for_Supply_Management, ism, nmi, non_manufacturing, Pandemic, services

|

--> www.FedPrimeRate.com Privacy Policy <--

CLICK HERE to JUMP to the TOP of THIS PAGE > SITEMAP < |

0 Comments:

Post a Comment

<< Home