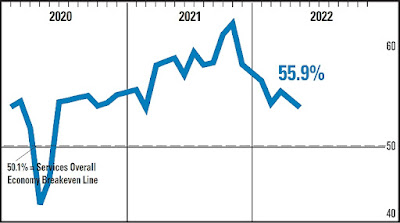

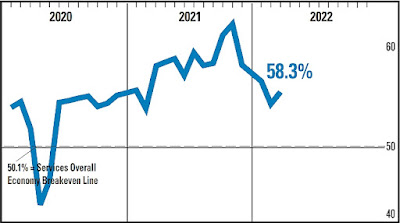

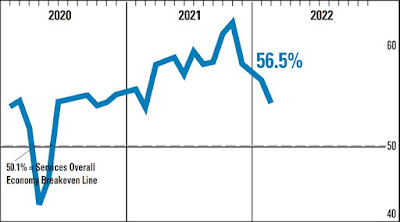

ISM Non-Manufacturing Index (NMI®) for May 2023

==========

Predicted: 51.0%

- Actual: 50.3% (-1.6 points month-on-month change)

==========

Previous month (revised): 51.9%

==========

The NMI is a reliable barometer of the U.S. services sector; above 50% implies expansion, while a reading below 50% implies that the services sector contracted.

Service Categories Include: Agriculture, Forestry, Fishing + Hunting; Mining; Utilities; Construction; Wholesale Trade; Retail Trade; Transportation + Warehousing; Information; Finance + Insurance; Real Estate, Rental + Leasing; Professional, Scientific + Technical Services; Management of Companies + Support Services; Educational Services; Health Care + Social Assistance; Arts, Entertainment + Recreation; Accommodation + Food Services; Public Administration; and Other Services (services such as Equipment + Machinery Repairing; Promoting or Administering Religious Activities; Grantmaking; Advocacy; and Providing Dry-Cleaning + Laundry Services, Personal Care Services, Death Care Services, Pet Care Services, Photofinishing Services, Temporary Parking Services, and Dating Services).

==========

From today' report:

"...Economic activity in the services sector expanded in May for the fifth consecutive month as the Services PMI® registered 50.3 percent, say the nation's purchasing and supply executives in the latest Services ISM® Report On Business®. The sector has grown in 35 of the last 36 months, with the lone contraction in December of last year..."===========

Made By Survey Participants:

- "...'Restaurant sales continue to track positive year over year, up an average of 8% past month. Employment needs have leveled off, and we are in a position to evaluate and upgrade rather than just maintain. Supply chain pressures have eased overall with some categories still hot spots. We are in a position to continue investing in technology upgrades and restaurant remodels.'

[Accommodation & Food Services]

- 'Overall slowing growth and market conditions dragging on some construction sectors.'

[Construction]

- 'As a higher-education institute, enrollment will have a major impact on our institution. Factors to consider will be the economy (state and national), as well as continued funding for education. Our enrollment is currently projected to drop 2.5%, which will have a negative effect on our budget.'

[Educational Services]

- 'Pent-up demand for services is driving strong revenue performance, but expenses (labor and supplies) continue to put pressure on margins, hindering the financial forecast. There is modest improvement in financial metrics, but it is becoming clear we will have to find ways to do more with less. Supply chains are stabilizing, though some segments remain choppy. The overall outlook, however, suggests the forecast is good for the next quarter. Pent-up demand for services is also causing capacity constraints, but we appear to be managing appropriately at this time.'

[Health Care & Social Assistance]

- 'Electronic components supply is strong, and lead times are nearly back to pre-pandemic.'

[Information]

- 'Economy is slowing amid increased financial banking and leasing activity. Credit standards have increased, and approvals have fallen -- thus, a tight credit situation.'

[Management of Companies & Support Services]

- 'Everything seems to have leveled off: not getting any worse, not getting any better.'

[Professional, Scientific & Technical Services]

- 'Lead times are starting to shorten, due in part to greater transportation availability. Prices, in general, are continuing to increase but at a slower pace. Supply chain is becoming much more reliable.'

[Public Administration]

- 'Overall business is good, and there has not been a significant change in direction.'

[Retail Trade]

- 'Business has significantly increased, with more orders, newer customers and more activity in general. More end users are getting back to business as usual, fighting for lower prices and taking a few more days to pay. The leverage point seems to have shifted back to end users, which is healthy.'

[Transportation & Warehousing]

- 'Business conditions continue to remain elevated as CapEx (capital expenditures) spending in clean energy follows regulatory demands.'

[Utilities]

===========

- 'Supply is plentiful, freight is moving quickly and costs are coming down. This is a 180-degree change from a year ago. Also, sales demand is down.'

[Wholesale Trade]..."

Labels: hard_data, Institute_for_Supply_Management, ism, nmi, non_manufacturing, services, Trade

|

--> www.FedPrimeRate.com Privacy Policy <--

CLICK HERE to JUMP to the TOP of THIS PAGE > SITEMAP < |