ISM Manufacturing Index for April 2022

Earlier today, the Institute for Supply Management® (ISM®) released their Manufacturing Purchasing Manager's Index (PMI®) for April 2022:

=========

Predicted: 57.0%

=========

Previous month (revised): 57.1%

=========

Every month, the ISM surveys purchasing and supply executives at hundreds of companies across the country who are involved in manufacturing in some form. The resulting index is watched closely by academics, economists and investors because manufacturing accounts for about 12% of U.S. Gross Domestic Product (GDP).

The PMI is a reliable barometer of U.S. manufacturing: A PMI above 50% implies that U.S. manufacturing expanded during the month specified, while a reading below 50% implies that the made-in-the-USA sector contracted.

=========

=========

Predicted: 57.0%

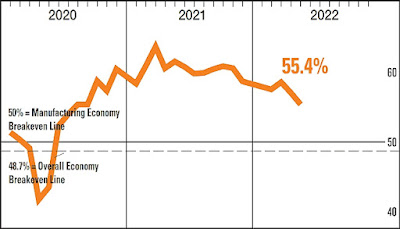

- Actual: 55.4% (-1.7 point month-on-month change)

=========

Previous month (revised): 57.1%

=========

Every month, the ISM surveys purchasing and supply executives at hundreds of companies across the country who are involved in manufacturing in some form. The resulting index is watched closely by academics, economists and investors because manufacturing accounts for about 12% of U.S. Gross Domestic Product (GDP).

The PMI is a reliable barometer of U.S. manufacturing: A PMI above 50% implies that U.S. manufacturing expanded during the month specified, while a reading below 50% implies that the made-in-the-USA sector contracted.

=========

From Today's Report:

"...The April Manufacturing PMI® registered 55.4%. This is the lowest reading since the July 2020 (53.9%.)

Economic activity in the manufacturing sector grew in April, with the overall economy achieving a 23rd consecutive month of growth, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®..."

=========

The Following Is A Sampling Of Quotes

From A Diverse Pool Of U.S. Manufacturers:

From A Diverse Pool Of U.S. Manufacturers:

- "...'Tier-2 supplier shutdowns in Shanghai are causing a ripple effect for our suppliers in other parts of China. Long delays at ports, including in the U.S., are still providing supply challenges. Inflation is out of control. Fuel costs, and therefore freight costs, are leading the upward cycle. At some point, the economy must give way; it will be tough to have real growth with such pressure on costs. Despite the issues and poor outlook, business remains brisk.'

[Chemical Products]

- 'Continued strong demand with improvements in the supply chain. Delays still exist, but supply issues are slowly improving. Cost increases in multiple categories.'

[Transportation Equipment]

- 'Supply chain is still constrained, and prices continue to rise. We are focusing on ways to stay profitable while continuing to fill customer orders. Relationship management and strong negotiation skills are extremely important right now.'

[Food, Beverage + Tobacco Products]

- 'New order entries are still very strong. Unfortunately, logistics issues have (not) yet improved, so lead times remain extended.'

[Machinery]

- 'Due to electronic component supply chain issues, production output has been lower than normal. Backlog is growing due to the supply chain issues. New order sales are steady, except international orders are lower.'

[Fabricated Metal Products]

- 'Business is strong. Backlog continues to grow due to new orders and inconsistent supply chain conditions. Shortages of components are the main factor limiting our production.'

[Electrical Equipment, Appliances + Components]

- 'The shutdowns in China due to a new COVID-19 wave are causing supply concerns for late second quarter and early third quarter. We have extended lead times to customers and are ordering product from China to cover demand through Q4 and early 1Q 2023.'

[Miscellaneous Manufacturing]

- 'Overall, improvements in supply chain are occurring on larger scale items, but we see suppliers that sell us low-volume items struggling in some cases with getting feed stocks and raw materials they need. Freight continues to plague things as well.'

[Nonmetallic Mineral Products]

- 'Business is still very robust. Material price increases continue to be passed on (to customers) based on costs of raw materials, logistics and labor to produce products.'

[Plastics + Rubber Products]..."

==========

Labels: Chip_Shortage, Computer_Chips, Coronavirus, COVID-19, COVID19, hard_data, inflation, ism, manufacturing, Pandemic, pmi, purchasing_managers_index, Supply_Chain

|

--> www.FedPrimeRate.com Privacy Policy <--

CLICK HERE to JUMP to the TOP of THIS PAGE > SITEMAP < |

0 Comments:

Post a Comment

<< Home