ISM Manufacturing Index for JANUARY 2026

=========

Predicted: 49.0%

- Actual: 52.6% (+4.7 points month-on-month change)

=========

Previous month: 47.9%

=========

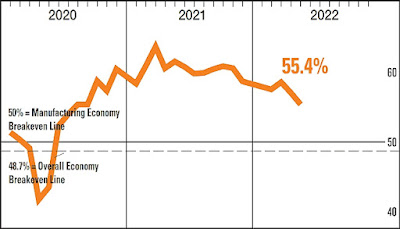

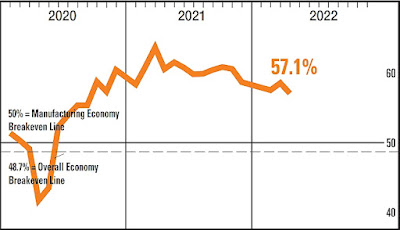

Every month, the ISM surveys purchasing and supply executives at hundreds of companies across the country who are involved in manufacturing in some form. The resulting index is watched closely by academics, economists and investors because manufacturing accounts for about 12% of U.S. Gross Domestic Product (GDP).

The PMI is a reliable barometer of U.S. manufacturing: A PMI above 50% implies that U.S. manufacturing expanded during the month specified, while a reading below 50% implies that the made-in-the-USA sector contracted.

=========

"...Economic activity in the manufacturing sector expanded in January for the first time in 12 months, preceded by 26 straight months of contraction, say the nation’s supply executives in the latest ISM® Manufacturing PMI® Report...."

=========

From A Diverse Pool Of U.S. Manufacturers:

- ' ‘Hope’ has been word of the year in the Transportation Equipment industry. Unfortunately, all the hope in the world has not materialized into order activity in 2025 or the first half of 2026. Across the board, buyers continue to stand on the sidelines. As we enter 2026, every conversation revolves around hope that the second half of 2026 starts the turnaround. It’s hard to set strategy on hope, but thanks to the uncertainty brought about by this administration, here we are.'

[Transportation Equipment]

- 'Although our volume is low at the moment, the impact on the latest tariff threats on the European Union will have a huge negative impact on our profit for current quoted orders. We will not be able to recover the increase tariffs in our current quotations.'

[Machinery]

- 'Continuing softness in the market, with December orders below average and buyers reluctant to spend despite beneficial tax policies in the U.S. Geopolitical tensions are fueling ‘anti-American’ buyer sentiment, and sales are being lost.'

[Machinery]

- 'Another round of emotionally charged tariffs seems imminent, changing the landscape once more. Movement of custom product out of China continues, but the progress is slow with new qualifications required for transitioned materials and assemblies.'

[Computer & Electronic Products]

- 'Business conditions remain uncertain. Customers are cautious. Broad-based inflation continues. The Supreme Court tariff decision looms.' [Computer & Electronic Products]

- 'Growing construction markets, data centers and energy projects, are straining the contract labor availability. The trade tariff uncertainty is creating volatility in the supply chain.'

[Food, Beverage & Tobacco Products]

- 'A new year, with new challenges. We are moving manufacturing from China to Mexico -- which will now impose tariffs on parts made in China. This push for more of a Mexican supply chain and creates some short-term supply management concerns.'

[Chemical Products]

- 'Confused and uninformed tariff policies continue to plague small companies, making long-term planning pointless. Companies are not making capital commitments beyond 30 days.'

[Fabricated Metal Products]

- 'Business conditions remain soft as we continue to miss sales, orders and profits as result of increased costs from tariffs, continued fallout from the government shutdown, and increased global uncertainty.'

[Miscellaneous Manufacturing]

- 'Business trends moving into 2026 feature many of the headwinds from the third and fourth quarters of 2025. While the ‘plane’ has steadied, there continues to be uncertainty and added costs through our global operations.

Tariff impacts on our financial performance last year cannot be overstated, as we had a much smaller EBITDA (earnings before interest, taxes, depreciation and amortization) than previous years. While other inflationary pressures continue to hit the business, tariffs and product costs played a large role. This year, we will continue our multi-country sourcing approach to manufacture and import product from more tariff-friendly countries outside of China.

But as we know, nothing is guaranteed with the current administration. We have trimmed costs everywhere inside the business, including on labor and conferences, and reduced our revenue forecast to a much more achievable mark. We’re prepared to battle throughout the year for higher profitability.'

[Apparel, Leather & Allied Products]

==========

Labels: FedPrimeRate, FedPrimeRate.com, hard_data, inflation, ism, manufacturing, pmi, purchasing_managers_index, Stagflation, Supply_Chain, tariffs, Trump_Tariffs

|

--> www.FedPrimeRate.com Privacy Policy <--

CLICK HERE to JUMP to the TOP of THIS PAGE > SITEMAP < |