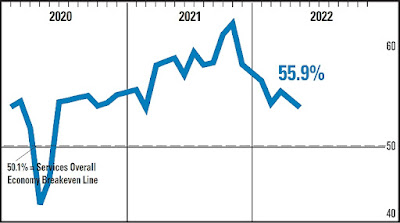

ISM Non-Manufacturing Index (NMI®) for May 2022

Earlier today, the Institute for Supply Management (ISM®) released their Non-Manufacturing Index (NMI®) for May 2022:

==========

Predicted: 56.0%

==========

Previous month (revised): 57.1%

==========

The NMI is a reliable barometer of the U.S. services sector; above 50% implies expansion, while a reading below 50% implies that the services sector contracted.

Service Categories Include: Agriculture, Forestry, Fishing + Hunting; Mining; Utilities; Construction; Wholesale Trade; Retail Trade; Transportation + Warehousing; Information; Finance + Insurance; Real Estate, Rental + Leasing; Professional, Scientific + Technical Services; Management of Companies + Support Services; Educational Services; Health Care + Social Assistance; Arts, Entertainment + Recreation; Accommodation + Food Services; Public Administration; and Other Services (services such as Equipment + Machinery Repairing; Promoting or Administering Religious Activities; Grantmaking; Advocacy; and Providing Dry-Cleaning + Laundry Services, Personal Care Services, Death Care Services, Pet Care Services, Photofinishing Services, Temporary Parking Services, and Dating Services).

==========

From today' report:

===========

==========

==========

Predicted: 56.0%

- Actual: 55.9% (-1.2 points month-on-month change)

==========

Previous month (revised): 57.1%

==========

The NMI is a reliable barometer of the U.S. services sector; above 50% implies expansion, while a reading below 50% implies that the services sector contracted.

Service Categories Include: Agriculture, Forestry, Fishing + Hunting; Mining; Utilities; Construction; Wholesale Trade; Retail Trade; Transportation + Warehousing; Information; Finance + Insurance; Real Estate, Rental + Leasing; Professional, Scientific + Technical Services; Management of Companies + Support Services; Educational Services; Health Care + Social Assistance; Arts, Entertainment + Recreation; Accommodation + Food Services; Public Administration; and Other Services (services such as Equipment + Machinery Repairing; Promoting or Administering Religious Activities; Grantmaking; Advocacy; and Providing Dry-Cleaning + Laundry Services, Personal Care Services, Death Care Services, Pet Care Services, Photofinishing Services, Temporary Parking Services, and Dating Services).

==========

From today' report:

"...Economic activity in the services sector grew in May for the 24th month in a row -- with the Services PMI® registering 55.9 percent -- say the nation’s purchasing and supply executives in the latest Services ISM® Report On Business®..."

===========

Here's A Sampling Of Comments

Made By Survey Participants::

Made By Survey Participants::

===========

- "...'Supply chain improving, with more reliability of supplier deliveries. Inflationary pressures increased on goods and services. Employment also improving in most markets. Fewer daily fires and more planning time.'

[Accommodation + Food Services]

'Demand seems to be very high for all of the high-voltage electric products we purchase. Lead times are quadruple what they normally are.'

[Construction]

'Long lead times continue to plague equipment deliveries; higher prices or surcharges added to pricing proposals. The ban on Russian imports is causing a shortage of gasses, especially helium. There has been an increase in new college applicants, signaling a strengthening of the higher education sector.'

[Educational Services]

'The paper industry is still being hampered by employment issues, freight costs and scarcity of truckers, as well as the war in Ukraine. European paper sent to North America is being slashed due to the war and the lack of fiber, along with high energy costs. Mills in North America are still struggling to keep up with demand.'

[Information]

'Unstable prices on various commodities are making budgetary planning difficult. We are maintaining a cautious approach due to energy costs continuing to increase.'

[Management of Companies + Support Services]

'Demand for all labor types remains strong, as open positions continue to exceed candidates to fill those positions. Light industrial, heavy industrial and information technology labor roles are particularly difficult to fill. Companies are having to pay more and offer incentives to attract talent. Resignations continue at a record pace across all age groups, and baby boomer retirements continue to increase.'

[Professional, Scientific + Technical Services]

'Concerns about how the new COVID-19 subvariants and rising cases may impact staffing.'

[Public Administration]

'Chip shortage showing no signs of easing.'

[Retail Trade]

'Exhausting. Continuous shortages, transportation delays and price increases all contribute to the destruction of historical lead times and firm commitments on delivery dates. This requires placing orders earlier and qualifying secondary sources. It is relentless.'

[Utilities]

'National consumer and builder demand continues to drive sales domestically. COVID-19 in China continues to affect our supply chain more than the Russia-Ukraine war.'

[Wholesale Trade]..."

==========

Labels: Coronavirus, COVID-19, COVID19, hard_data, Institute_for_Supply_Management, ism, nmi, non_manufacturing, Pandemic, services, Trade

|

--> www.FedPrimeRate.com Privacy Policy <--

CLICK HERE to JUMP to the TOP of THIS PAGE > SITEMAP < |

0 Comments:

Post a Comment

<< Home