ISM Manufacturing Index for March 2022

Earlier today, the Institute for Supply Management® (ISM®) released their Manufacturing Purchasing Manager's Index (PMI®) for March 2022:

=========

Predicted: 58.0%

=========

Previous month (revised): 58.6%

=========

Every month, the ISM surveys purchasing and supply executives at hundreds of companies across the country who are involved in manufacturing in some form. The resulting index is watched closely by academics, economists and investors because manufacturing accounts for about 12% of U.S. Gross Domestic Product (GDP).

The PMI is a reliable barometer of U.S. manufacturing: A PMI above 50% implies that U.S. manufacturing expanded during the month specified, while a reading below 50% implies that the made-in-the-USA sector contracted.

=========

=========

Predicted: 58.0%

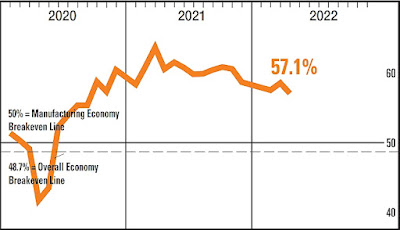

- Actual: 57.1% (-1.5 point month-on-month change)

=========

Previous month (revised): 58.6%

=========

Every month, the ISM surveys purchasing and supply executives at hundreds of companies across the country who are involved in manufacturing in some form. The resulting index is watched closely by academics, economists and investors because manufacturing accounts for about 12% of U.S. Gross Domestic Product (GDP).

The PMI is a reliable barometer of U.S. manufacturing: A PMI above 50% implies that U.S. manufacturing expanded during the month specified, while a reading below 50% implies that the made-in-the-USA sector contracted.

=========

From Today's Report:

"...Economic activity in the manufacturing sector grew in March, with the overall economy achieving a 22nd consecutive month of growth, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®..."

=========

The Following Is A Sampling Of Quotes

From A Diverse Pool Of U.S. Manufacturers:

From A Diverse Pool Of U.S. Manufacturers:

- "...'No letup yet in supply chain challenges, especially electronic components. Relying more and more on the broker market.'

[Computer + Electronic Products]

- 'Customer orders are brisk in the face of significant price increases, while we continue to struggle with inbound supplier service and raw material availability issues.'

[Chemical Products]

- 'Generally speaking, the business environment is slowly improving for aerospace component manufacturers. Supply chain disruptions and still-extending lead times continue to keep purchasing busy. This further causes reevaluation of the current year’s business plan and cost assumptions.'

[Transportation Equipment]

- 'Overall business conditions are challenging in both domestic and international transportation. The Russian invasion of Ukraine has created uncertainty in the grain markets, causing upward pricing pressure. In addition, inflationary pressures across all categories have made it challenging to manage cost and profitability.'

[Food, Beverage + Tobacco Products]

- 'Prices are increasing on steel and steel products after a slight decrease from highs last month. Transportation costs are going up significantly with the increase in fuel prices.'

[Machinery]

- 'Backlog continues to be strong as we ship delinquent orders resulting from COVID-19 slowdowns.' [Fabricated Metal Products]

'Demand continues to be strong. Backlog is still increasing -- currently at about three months of production. Availability of purchased material continues to constrain production, causing the increased backlog.'

[Electrical Equipment, Appliances + Components]

- 'The supply situation is getting worse, with lead times extending over 12 months, material not available, and suppliers not quoting or taking orders. Prices on the rise daily.'

[Miscellaneous Manufacturing]

- 'Supply chain is still unstable. While we have seen improvements, there are still a lot of issues that have yet to be resolved.'

[Primary Metals]..."

==========

Labels: Chip_Shortage, Computer_Chips, Coronavirus, COVID-19, COVID19, hard_data, inflation, ism, manufacturing, Pandemic, pmi, purchasing_managers_index, Supply_Chain

|

--> www.FedPrimeRate.com Privacy Policy <--

CLICK HERE to JUMP to the TOP of THIS PAGE > SITEMAP < |

0 Comments:

Post a Comment

<< Home