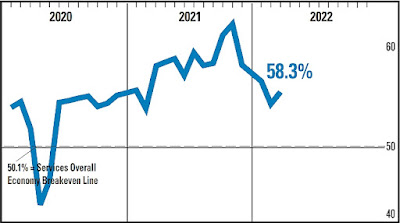

ISM Non-Manufacturing Index (NMI®) for March 2022

Earlier today, the Institute for Supply Management (ISM®) released their Non-Manufacturing Index (NMI®) for March 2022:

==========

Predicted: 58.0%

==========

Previous month (revised): 56.5%

==========

The NMI is a reliable barometer of the U.S. services sector; above 50% implies expansion, while a reading below 50% implies that the services sector contracted.

Service Categories Include: Agriculture, Forestry, Fishing + Hunting; Mining; Utilities; Construction; Wholesale Trade; Retail Trade; Transportation + Warehousing; Information; Finance + Insurance; Real Estate, Rental + Leasing; Professional, Scientific + Technical Services; Management of Companies + Support Services; Educational Services; Health Care + Social Assistance; Arts, Entertainment + Recreation; Accommodation + Food Services; Public Administration; and Other Services (services such as Equipment + Machinery Repairing; Promoting or Administering Religious Activities; Grantmaking; Advocacy; and Providing Dry-Cleaning + Laundry Services, Personal Care Services, Death Care Services, Pet Care Services, Photofinishing Services, Temporary Parking Services, and Dating Services).

==========

From today' report:

===========

==========

==========

Predicted: 58.0%

- Actual: 58.3% (+1.8 points month-on-month change)

==========

Previous month (revised): 56.5%

==========

The NMI is a reliable barometer of the U.S. services sector; above 50% implies expansion, while a reading below 50% implies that the services sector contracted.

Service Categories Include: Agriculture, Forestry, Fishing + Hunting; Mining; Utilities; Construction; Wholesale Trade; Retail Trade; Transportation + Warehousing; Information; Finance + Insurance; Real Estate, Rental + Leasing; Professional, Scientific + Technical Services; Management of Companies + Support Services; Educational Services; Health Care + Social Assistance; Arts, Entertainment + Recreation; Accommodation + Food Services; Public Administration; and Other Services (services such as Equipment + Machinery Repairing; Promoting or Administering Religious Activities; Grantmaking; Advocacy; and Providing Dry-Cleaning + Laundry Services, Personal Care Services, Death Care Services, Pet Care Services, Photofinishing Services, Temporary Parking Services, and Dating Services).

==========

From today' report:

"...Economic activity in the services sector grew in March for the 22nd month in a row, with the Services PMI® registering 58.3 percent, say the nation's purchasing and supply executives in the latest Services ISM® Report On Business®..."

===========

Here's A Sampling Of Comments

Made By Survey Participants::

Made By Survey Participants::

===========

- "...'Supply chain challenges continue at about the same levels as last month. Employment has improved as COVID-19 cases are declining. Restaurant sales have improved since Valentine’s Day, with mask and vaccine verification mandates being dropped.'

[Accommodation + Food Services]

'Grain and fertilizer prices are near all-time highs, resulting in decreased purchasing.'

[Agriculture, Forestry, Fishing + Hunting]

'Labor and inflation continue to push costs higher across the board for food and food-service supplies.'

[Educational Services]

'Pricing pressures are stronger than ever due to the Russia-Ukraine [war], and energy costs are skyrocketing.'

[Construction]

'Supply chain disruptions are still a problem due to reduced allocations and manufacturer back orders. Demand continues to outpace manufacturing capacity.'

[Health Care + Social Assistance]

'Energy costs are putting a pinch on all suppliers. We have received many surcharge notices.'

[Information]

'Concerns over inflation and rising energy prices are causing our company to take a cautious approach, especially related to planned capital expenditures.'

[Management of Companies + Support Services]

'Long lead times for electronic components are becoming normal and expected. Chemical deliveries are often delayed due to a lack of qualified hazardous materials drivers.'

[Public Administration]

'Global supply chain issues continue to disrupt chip supply, which is suppressing production of new vehicles.'

[Retail Trade]

'We are still seeing raw material subcomponent shortages, transportation delays and price increases.'

[Utilities]

'Constrained supply of many key product groups continues. Inflation worsening. Overall sales and profitability continue to be strong.'

[Wholesale Trade]..."

==========

Labels: Coronavirus, COVID-19, COVID19, hard_data, Institute_for_Supply_Management, ism, nmi, non_manufacturing, Pandemic, services

|

--> www.FedPrimeRate.com Privacy Policy <--

CLICK HERE to JUMP to the TOP of THIS PAGE > SITEMAP < |

0 Comments:

Post a Comment

<< Home