The

Consumer Confidence Index® (CCI) for this month (June 2022) was

released by

The Conference Board® this morning:

================

Predicted: 99.0

================

Previous Month (revised):

103.2

- Change from Previous Month: -4.36% (-4.5 points)

================

The "predicted" figure is what economists were expecting, while the "actual" is the true or real figure.

From Today's Report:

"...Index Drops to Lowest Level Since February 2021 as Expectations Continue to Decline

The Conference Board Consumer Confidence Index® decreased in June, following a decline in May. The Index fell to 98.7 (1985=100)—down 4.5 points from 103.2 in May -- and now stands at its lowest level since February 2021 (Index, 95.2). The Present Situation Index -- based on consumers’ assessment of current business and labor market conditions -- declined marginally to 147.1 from 147.4 last month. The Expectations Index -- based on consumers’ short-term outlook for income, business, and labor market conditions -- decreased sharply to 66.4 from 73.7 and is at its lowest level since March 2013 (Index, 63.7).

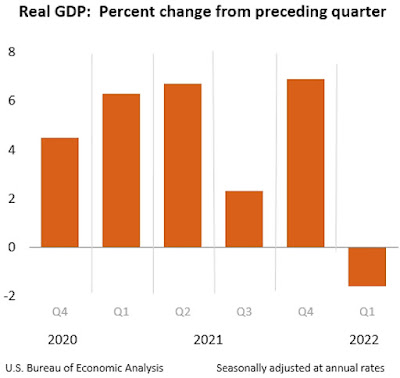

'Consumer confidence fell for a second consecutive month in June,' said Lynn Franco, Senior Director of Economic Indicators at The Conference Board. 'While the Present Situation Index was relatively unchanged, the Expectations Index continued its recent downward trajectory -- falling to its lowest point in nearly a decade. Consumers’ grimmer outlook was driven by increasing concerns about inflation, in particular rising gas and food prices. Expectations have now fallen well below a reading of 80, suggesting weaker growth in the second half of 2022 as well as growing risk of recession by year-end.'

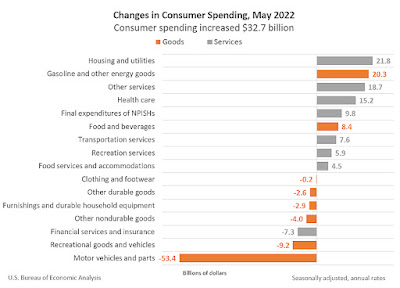

'Purchasing intentions for cars, homes, and major appliances held relatively steady -- but intentions have cooled since the start of the year and this trend is likely to continue as the Fed aggressively raises interest rates to tame inflation. Meanwhile, vacation plans softened further as rising prices took their toll. Looking ahead over the next six months, consumer spending and economic growth are likely to continue facing strong headwinds from further inflation and rate hikes.'..."

Every month, The Conference Board sends a questionnaire to 5,000 U.S.

households. Survey participants are polled about their feelings

regarding the U.S. economy, current and future, and about their own

fiscal circumstances. On average, 3,500 participants complete and return

the 5-question survey.

- The baseline "100" score for the CCI is associated with 1985 survey data.

When consumers feel good about the economy, they tend to do more spending, and vice versa.

Based in New York City, The Conference Board is a private,

not-for-profit organization with a mission to, "create and disseminate

knowledge about management and the marketplace to help businesses

strengthen their performance and better serve society."

The CCI is usually released on the last Tuesday of the month.

================

CHART: Consumer Confidence Index (CCI)

June 2022 Update

================

================

Labels: cci, Conference_Board, consumer_confidence, consumer_spending, consumers, Coronavirus, COVID-19, COVID19, inflation, Inflation_Expectations, Pandemic, soft_data, The_Conference_Board