Employment Situation Report for February 2024

Actual: +275,000

One Year Previous: 287,000

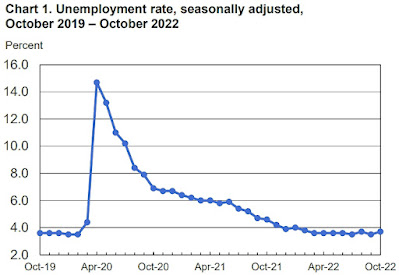

U-3 Unemployment Rate (Headline)

Actual: 3.9%

Previous Month: 3.7%

12 Months Previous: 3.6%

U-6 Unemployment Rate*

Actual: 7.3%

Previous Month: 7.2%

12 Months Previous: 6.8%

Average Hourly Earnings (month-to-month change)

Predicted: +0.4%

Actual: +0.145% (+$0.05)

Average Hourly Earnings (year-on-year change)

Predicted: +4.3%

Actual: +4.28% (+$1.42)

Average Weekly Earnings (month-to-month change)

Actual: +0.44% (+$5.17)

Average Weekly Earnings (year-on-year change)

Actual: +3.68% (+$42.07)

Civilian Labor Force Participation Rate: 62.5%

Previous Month: 62.5%

12 Months Previous: 62.5%

Average Workweek

Predicted: 34.3 hours

Actual: 34.3 hours

Economist, academics, central bankers and investors pay very close attention to the monthly Employment Situation report as it offers penetrating insight as to the current and near-future state of the overall U.S. economy. If a) Americans are earning more money and b) the economy is creating new jobs, this typically translates to more money being pumped into the economy (and vice versa.)

The "predicted" figure is what economists were expecting, while the "actual" is the true or real figure.

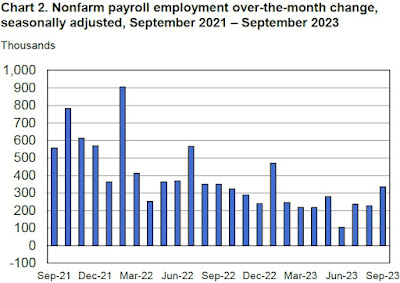

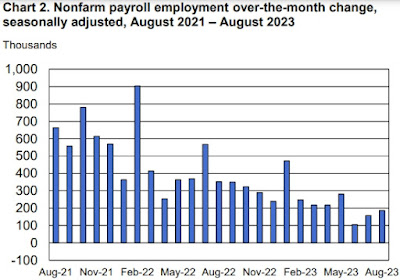

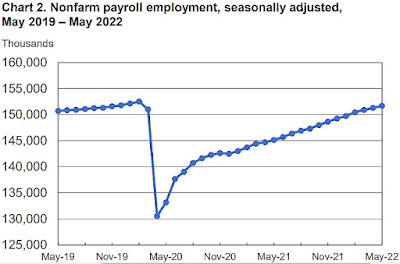

In Nonfarm Payroll Employment

February 2022 thru February 2024

* = The U-6 Unemployment Rate is defined as:

"Total unemployed, plus all persons marginally attached to the labor force, plus total employed part time for economic reasons, as a percent of the civilian labor force plus all persons marginally attached to the labor force."

===================

===================

Labels: Career, Careers, Earnings, employment, employment_situation, Income, jobless, jobs, labor, new_economy, Pandemic, Payroll_Employment, Payrolls, personal_income, Telework, Teleworking, unemployment, wages, Work

|

--> www.FedPrimeRate.com Privacy Policy <--

CLICK HERE to JUMP to the TOP of THIS PAGE > SITEMAP < |