Consumer Confidence Index (CCI) for April 2024

================

Predicted: 99.0

- Actual: 97.0

================

Previous Month (revised): 103.1

- Change from Previous Month: -5.92% (-6.1 points)

The "predicted" figure is what economists were expecting, while the "actual" is the true or real figure.

From Today's Report:

"...'Confidence retreated further in April, reaching its lowest level since July 2022 as consumers became less positive about the current labor market situation, and more concerned about future business conditions, job availability, and income,' said Dana M. Peterson, Chief Economist at The Conference Board. 'Despite April’s dip in the overall index, since mid-2022, optimism about the present situation continues to more than offset concerns about the future."

'In the month, confidence declined among consumers of all age groups and almost all income groups except for the $25,000 to $49,999 bracket. Nonetheless, consumers under 35 continued to express greater confidence than those over 35. In April, households with incomes below $25,000 and those with incomes above $75,000 reported the largest deteriorations in confidence. However, over a six-month basis, confidence for consumers earning less than $50,000 has been stable, but confidence among consumers earning more has weakened.'

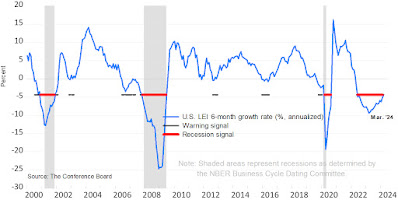

Peterson added: 'According to April’s write-in responses, elevated price levels, especially for food and gas, dominated consumer’s concerns, with politics and global conflicts as distant runners-up. Average 12-month inflation expectations remained stable at 5.3% despite concerns about food and energy prices. Consumers ’ Perceived Likelihood of a U.S. Recession over the Next 12 Months rose slightly in April but is still well below the May 2023 peak.'..."

Every month, The Conference Board sends a questionnaire to 5,000 U.S. households. Survey participants are polled about their feelings regarding the U.S. economy, current and future, and about their own fiscal circumstances. On average, 3,500 participants complete and return the 5-question survey.

- The baseline "100" score for the CCI is associated with 1985 survey data.

When consumers feel good about the economy, they tend to do more spending, and vice versa.

Based in New York City, The Conference Board is a private,

not-for-profit organization with a mission to, "create and disseminate

knowledge about management and the marketplace to help businesses

strengthen their performance and better serve society."

The CCI is usually released on the last Tuesday of the month.

================

================

Where Consumers Are Planning to Cut Back

================

- Click here to view the full Conference Board report.

================

Labels: cci, Conference_Board, consumer_confidence, consumer_spending, consumers, inflation, Inflation_Expectations, Recession, Recession_Expectations, Shopping, soft_data, Spending, The_Conference_Board, Trade

|

--> www.FedPrimeRate.com Privacy Policy <--

> SITEMAP < |