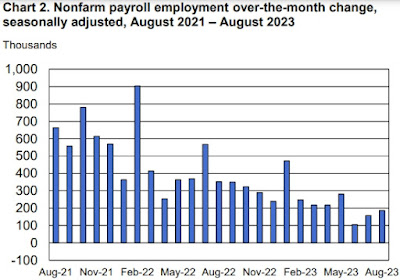

New Unemployment Insurance Claims for The Week of September 23, 2023

|

| Jobless Claims |

Earlier today, the Labor Department released its weekly report on New Jobless Insurance Claims for the week that ended on September 23, 2023:

====================

Predicted: 210,000

- Actual: 204,000

The yellow-highlighted figure represents the number of first-time claims for unemployment benefits for the entire United States. The "predicted" figure is what economists were expecting, while the "actual" is the true or real figure.

- Previous Week (revised): 202,000

- 4-Week Moving Average: 211,000

====================

Labels: Career, Careers, discharges, employment, hard_data, jobless, jobless claims, jobs, labor, layoffs, separations, unemployment, Work

|

--> www.FedPrimeRate.com Privacy Policy <--

> SITEMAP < |