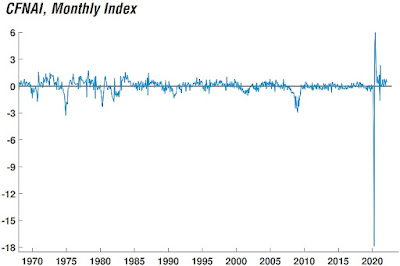

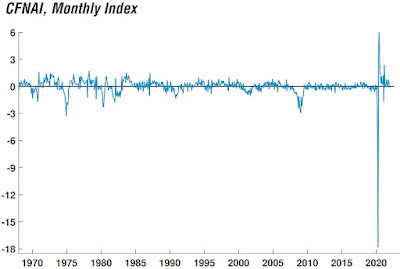

Chicago Fed National Activity Index (CFNAI) for January 2025

==================

- Actual (CFNAI): -0.03

==================

- Previous Month (revised): N/A

- 3-Month Moving Average (CFNAI-MA3): +0.03

The CFNAI is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data:

- Production and income;

- Employment, unemployment, and hours;

- Personal consumption and housing; and

- Sales, orders, and inventories.

The "predicted" figure is what economists were expecting, while the yellow-highlighted figure is what was reported.

==================

January 2025 Update

===================

Understanding The CFNAI:

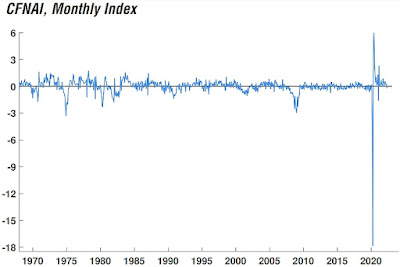

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

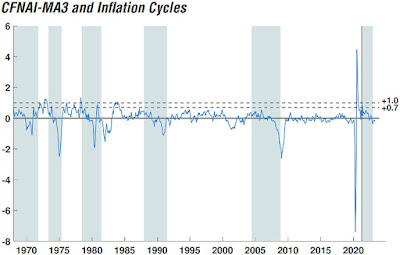

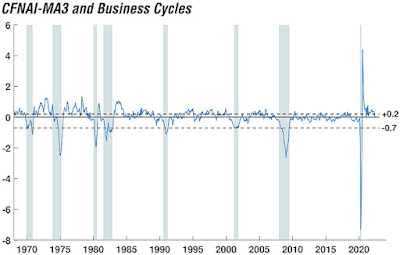

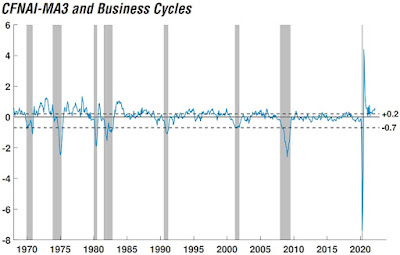

Periods of economic expansion have historically been associated with values of the CFNAI-MA3 above -0.70 and the CFNAI Diffusion Index above -0.35. Conversely, periods of economic contraction have historically been associated with values of the CFNAI-MA3 below -0.70 and the CFNAI Diffusion Index below -0.35.

An increasing likelihood of a period of sustained increasing inflation has historically been associated with values of the CFNAI-MA3 above +0.70 more than two years into an economic expansion. Similarly, a substantial likelihood of a period of sustained increasing inflation has historically been associated with values of the CFNAI-MA3 above +1.00 more than two years into an economic expansion.

==================

==================

Labels: CFNAI, Chicago_Fed, Consumption, Economic_Indicators, Federal_Reserve, hard_data, Home Sales, housing, Income, inflation, jobs, National_Activity_Index, Orders, Production

|

--> www.FedPrimeRate.com Privacy Policy <--

CLICK HERE to JUMP to the TOP of THIS PAGE > SITEMAP < |