Leading Economic Index for April 2023

==============

Index for April 2023: 107.5 (The baseline 100 score is associated with 2016 data.)

==============

Predicted: -0.5%

- Actual: -0.647% (-0.7 point)

==============

- LEI for March 2023: 108.2

- LEI for February 2023: 109.5

- LEI for January 2023: 110.2

- LEI for December 2022: 110.7

- LEI for November 2022: 111.5

- LEI for October 2022: 112.5

- LEI for September 2022: 113.5

- LEI for August 2022: 116.4

- LEI for July 2022: 116.4

- LEI for June 2022: 117.1

- LEI for May 2022: 117.9

- LEI for April 2022: 118.7

- LEI for March 2022: 119.3

- LEI for February 2022: 119.4

- LEI for January 2022: 118.5

==============

The yellow-highlighted percentage is the month-to-month change for the index. The "predicted" figure is what economists were expecting, while the "actual" is the true or real figure.

The LEI is a composite of 10 of the nation's economic data releases that's put together by The Conference Board. Statistically, the components listed below have shown a significant increase or decrease before national economic upturns or downturns:

- The Standard + Poor's 500 Index

- Average weekly claims for unemployment insurance

- Building permits for new private housing

- The interest rate spread between the yield on the benchmark 10-Year Treasury Note and Federal Funds

- ISM® Index of New Orders

- Manufacturer's new orders for consumer goods or materials

- Manufacturers' new orders, non-defense capital goods excluding aircraft orders

- Average weekly manufacturing hours

- Average consumer expectations for business conditions

- Leading Credit Index™

==============

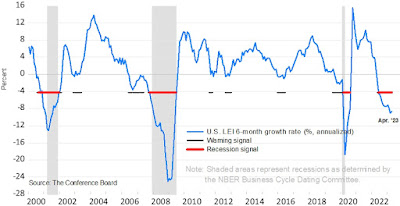

"...'The LEI for the US declined for the thirteenth consecutive month in April, signaling a worsening economic outlook,' said Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board. 'Weaknesses among underlying components were widespread, but less so than in March’s reading, which resulted in a smaller decline.

Only stock prices and manufacturers’ new orders for both capital and consumer goods improved in April.

Importantly, the LEI continues to warn of an economic downturn this year. The Conference Board forecasts a contraction of economic activity starting in Q2 leading to a mild recession by mid-2023.'..."

==============

Labels: Economy, hard_data, Leading_Economic_Index, leading_economic_indicators, Recession, Recession_Fears, Recession_Risk, Recession_Signal, Recession_Signals, Recession_Warning, The_Conference_Board

|

--> www.FedPrimeRate.com Privacy Policy <--

CLICK HERE to JUMP to the TOP of THIS PAGE > SITEMAP < |