Consumer Confidence Index® (CCI) for this month (February) was

released by

The Conference Board® this morning:

================

Predicted: 112.0

================

Previous Month (revised):

110.9

- Change from Previous Month: -3.79% (-4.2 points)

================

The "predicted" figure is what economists were expecting, while the "actual" is the true or real figure.

From Today's Report:

"...The Conference Board Consumer Confidence Index® fell in February to 106.7 (1985 = 100), down from a revised 110.9 in January. February’s decline in the Index occurred after three consecutive months of gains. However, as January was revised downward from the preliminary reading of 114.8, the data now suggest that there was not a material breakout to the upside in confidence at the start of 2024.

The Present Situation Index -- based on consumers’ assessment of current business and labor market conditions -- fell back to 147.2 (1985 = 100) in February from 154.9 in January. The Expectations Index -- based on consumers’ short-term outlook for income, business, and labor market conditions -- slipped to 79.8 (1985 = 100), down from a revised 81.5 in January. An Expectations Index reading below 80 often signals recession ahead.

'The decline in consumer confidence in February interrupted a three-month rise, reflecting persistent uncertainty about the US economy,' said Dana Peterson, Chief Economist at The Conference Board. 'The drop in confidence was broad-based, affecting all income groups except households earning less than $15,000 and those earning more than $125,000. Confidence deteriorated for consumers under the age of 35 and those 55 and over, whereas it improved slightly for those aged 35 to 54.'

Peterson added: 'February’s write-in responses revealed that while overall inflation remained the main preoccupation of consumers, they are now a bit less concerned about food and gas prices, which have eased in recent months. But they are more concerned about the labor market situation and the US political environment.'

Assessments of the present situation weakened in February, as consumers’ views of both business conditions and the employment situation became less favorable. Furthermore, consumers’ assessments of their personal financial situation (a measure not included in calculating the Present Situation Index) also weakened.

Consumer expectations for the next six months deteriorated in February, driven by renewed pessimism regarding future business and labor market conditions. Consumers were also a bit less optimistic about their family financial situation over the next six months (a measure not included in calculating the Expectations Index). Additionally, consumers’ Perceived Likelihood of a US Recession over the Next 12 Months picked back up after falling over the previous three months.

On a six-month basis, buying plans for autos, homes, and big-ticket appliances dipped slightly. The share of consumers planning a vacation over the next six months also declined. Expectations that interest rates will rise over the year ahead picked up slightly to 42.7%, which may have influenced buying plans. Meanwhile, consumers remained upbeat about stock prices over the year ahead.

Average 12-month inflation expectations ticked down further to 5.2% in February. After peaking at 7.9% in mid-2022, expected inflation has now fallen to its lowest level since March 2020, when it stood at 4.5%. This aligns with continued slowing in consumer price inflation in government reports and fewer complaints about food and energy prices in our survey.

Present Situation

Consumers’ assessment of current business conditions fell slightly in February.

21.2% of consumers said business conditions were 'good,' down slightly from 21.3% in January.

17.1% said business conditions were 'bad,' up from 15.3%.

Consumers’ appraisal of the labor market was also less positive in February.

41.3% of consumers said jobs were 'plentiful,' down from 42.7% in January.

13.5% of consumers said jobs were 'hard to get,' up from 11.0%.

Expectations Six Months Hence

Consumers were, on balance, more pessimistic about the short-term business conditions outlook in February.

14.8% of consumers expect business conditions to improve, down from 16.7% in January.

15.5% expect business conditions to worsen, down from 16.0%.

Consumers’ assessment of the short-term labor market outlook was more pessimistic in February.

14.7% of consumers expect more jobs to be available, down from 15.6% in January.

17.3% anticipate fewer jobs, up from 16.7%.

Consumers’ assessment of their short-term income prospects was, on balance, more optimistic in February.

16.9% of consumers expect their incomes to increase, down from 17.1% in January.

11.3% expect their incomes to decrease, down from 12.5%.

Assessment of Family Finances and Recession Risk

Consumers’ assessment of their Family’s Current Financial Situation was less positive in February.

Consumers were a bit less optimistic about their Family’s Financial Situation going forward.

Consumers’ Perceived Likelihood of a US Recession over the Next 12 Months ticked up in February.

Consumers’ assessment of their Family’s Current Financial Situation was less positive in February.

Consumers were a bit less optimistic about their Family’s Financial Situation going forward.

Consumers’ Perceived Likelihood of a US Recession over the Next 12 Months ticked up in February..."

Every month, The Conference Board sends a questionnaire to 5,000 U.S.

households. Survey participants are polled about their feelings

regarding the U.S. economy, current and future, and about their own

fiscal circumstances. On average, 3,500 participants complete and return

the 5-question survey.

- The baseline "100" score for the CCI is associated with 1985 survey data.

When consumers feel good about the economy, they tend to do more spending, and vice versa.

Based in New York City, The Conference Board is a private,

not-for-profit organization with a mission to, "create and disseminate

knowledge about management and the marketplace to help businesses

strengthen their performance and better serve society."

The CCI is usually released on the last Tuesday of the month.

================

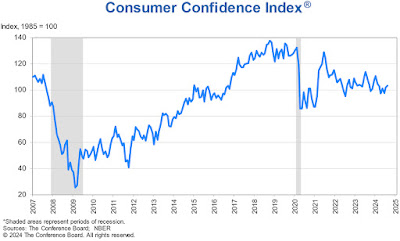

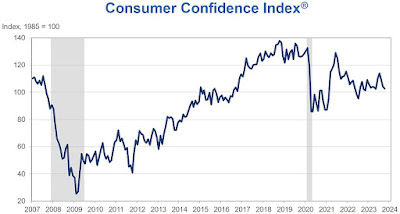

CHART: Consumer Confidence Index (CCI)

February 2024 Update

================

CHART: Perceived Likelihood of A Recession

Over The Next 12 Months

FEBRUARY 2024 UPDATE

================

Labels: cci, Conference_Board, consumer_confidence, consumer_spending, consumers, inflation, Inflation_Expectations, Recession, Recession_Expectations, Shopping, soft_data, Spending, The_Conference_Board, Trade