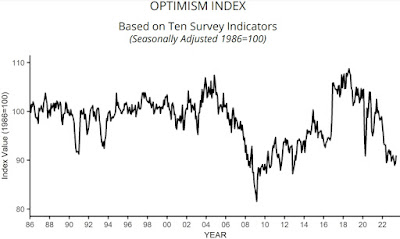

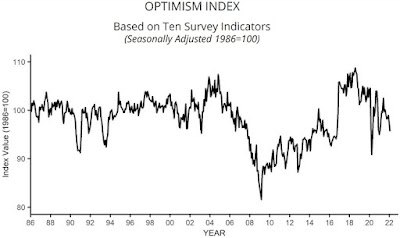

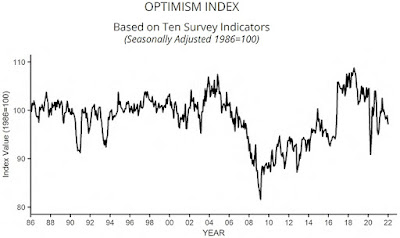

NFIB Small Business Optimism Index (SBOI) for OCTOBER 2025

=========

Predicted: 98.5

- Actual: 98.2

----------------

- Change from Previous Month: -0.61% (-0.6 point.)

- Change from A Year Ago: +4.8% (+4.5 points.)

=========

=========

- The baseline "100" score is associated with 1986 survey data.

"...OVERVIEW

Uncertainty, while lower than in September, remained high. The upcoming elections (Oct. Survey) and government shutdown likely played a role. Small business owners were reasonably optimistic at the start of the year (Optimism Index at 102.8), but it has been a downhill slide through the last nine or so months with the current reading closing in on the 52-year average of 98. Foreign policy dominates the headlines, with a focus on tariff policy, raising lots of consternation about the cost of inputs and pressures to raise prices. Sales were not strong, and profits took a hit in the third quarter; lots of owners reported profit declines.

In October, both actual and planned price increases fell from the previous month. The net percent of owners raising average selling prices fell 3 points from September to a net 21% (seasonally adjusted). Despite the decline, price increases remain above the monthly average of a net 13%, suggesting continued inflationary pressure. Unadjusted, 31% reported higher average prices (down 2 points), and 12% reported lower average selling prices (up 2 points). Looking forward to the next three months, a net 30% (seasonally adjusted) plan to increase prices (down 1 point from September). Twelve percent of owners reported that inflation was their single most important problem in operating their business (higher input costs), down 2 points from September.A net 5% reported their last loan was harder to get than in previous attempts, down 2 points from September’s highest reading of this year. In October, a net 1% of owners reported paying a higher interest rate on their most recent loan, down 6 points from September. The average rate paid on short maturity loans was 8.7% in October, down 0.1 point from September. Twenty-three percent of all owners reported borrowing on a regular basis, down 3 points from September..."

- CREDIT MARKETS

- Previous Month's SBOI: 98.8

- SBOI, 12-Months Previous: 93.7

=========

Labels: business, Credit_Markets, FedPrimeRate, FedPrimeRate.com, hard_data, inflation, Interest_Rates, jobs, NFIB, Small_Business, Small_Business_Optimism_Index, Small_Business_Outlook, soft_data

|

--> www.FedPrimeRate.com Privacy Policy <--

CLICK HERE to JUMP to the TOP of THIS PAGE > SITEMAP < |