The

Consumer Confidence Index® (CCI) for this month (April 2022) was

released by

The Conference Board® this morning:

================

Predicted: 105.0

================

Previous Month (revised):

107.6

- Change from Previous Month: -0.279% (-0.3 point)

================

The "predicted" figure is what economists were expecting, while the "actual" is the true or real figure.

From Today's Report:

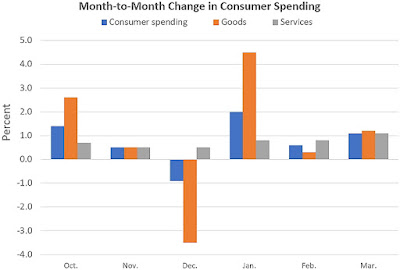

"...'Consumer confidence fell slightly in April, after a modest increase in March,' said Lynn Franco, Senior Director of Economic Indicators at The Conference Board. 'The Present Situation Index declined, but remains quite high, suggesting the economy continued to expand in early Q2. Expectations, while still weak, did not deteriorate further amid high prices, especially at the gas pump, and the war in Ukraine. Vacation intentions cooled but intentions to buy big-ticket items like automobiles and many appliances rose somewhat.'

'Still, purchasing intentions are down overall from recent levels as interest rates have begun rising. Meanwhile, concerns about inflation retreated from an all-time high in March but remained elevated. Looking ahead, inflation and the war in Ukraine will continue to pose downside risks to confidence and may further curb consumer spending this year.'..."

Every month, The Conference Board sends a questionnaire to 5,000 U.S.

households. Survey participants are polled about their feelings

regarding the U.S. economy, current and future, and about their own

fiscal circumstances. On average, 3,500 participants complete and return

the 5-question survey.

- The baseline "100" score for the CCI is associated with 1985 survey data.

When consumers feel good about the economy, they tend to do more spending, and vice versa.

Based in New York City, The Conference Board is a private,

not-for-profit organization with a mission to, "create and disseminate

knowledge about management and the marketplace to help businesses

strengthen their performance and better serve society."

The CCI is usually released on the last Tuesday of the month.

================

CHART: Consumer Confidence Index (CCI)

April 2022 Update

================

================

Labels: cci, Conference_Board, consumer_confidence, consumer_spending, consumers, Coronavirus, COVID-19, COVID19, inflation, Inflation_Expectations, Pandemic, soft_data, The_Conference_Board