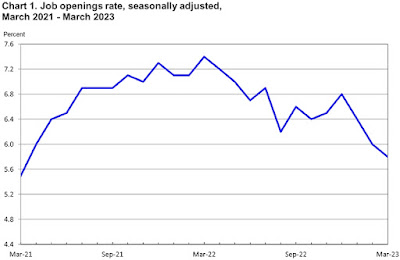

Job Openings and Labor Turnover Survey (JOLTS) for April 2023

=============

Job Openings

- Actual: 10,103,000

- Previous Month (revised): 9,745,000

- One Year Previous: 11,755,000

- Change from one year previous: -14.054% (-1,652,000)

=============

Hires: 6,115,000

Quits: 3,793,000

-----------

Layoffs + Discharges: 1,581,000

-----------

Total Separations §: 5,708,000

=============

§ = Here's How The Labor Department Defines Total Separations:

"Total separations includes quits, layoffs and discharges, and other separations. Total separations is referred to as turnover. Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. Layoffs and discharges are involuntary separations initiated by the employer. Other separations includes separations due to retirement, death, disability, and transfers to other locations of the same firm."

=============

April 2023 UPDATE

=============

- * = The JOLTS data series began back in December of 2000.

- Click here to view the full Labor Department JOLTS report.

Labels: discharges, employment, hard_data, Hires, Job_Openings, jobs, JOLTS, labor, layoffs, quits, separations

|

--> www.FedPrimeRate.com Privacy Policy <--

CLICK HERE to JUMP to the TOP of THIS PAGE > SITEMAP < |